Accounting

Purchase

Sales

Orders

Inventory

Returns

Sales Force Physical Returns

Schedule a Physical Return

Capture a Physical Return and Print a Returns Checking Slip

Validate a Physical Return

Create a Distributor Credit note

Sales Force Virtual Returns

Capture a Virtual Return and Print a Returns Checking Slip

Validate a Virtual Return

Issue a Distributor Credit note and Re-Invoice

Return to Supplier

Return to Supplier (Manual)

Internal Breakages

Distributor Breakages (Replacement)

Capture a Distributor Breakage (Replacements) and Print a Return Checking Slip

Validating a Distributor Breakage - Replacement

Distributor Breakages (Credit Note)

Capture a Distributor Breakage and Print a Returns Checking Slip

Validate a Distributor Breakage (Credit Note)

Create a Distributor Breakage Credit note

Adjustments

Corrections

Products

Manufacturing

Attendance Register

Help

Additional Help

Installing Odoo as an application

Two Factor Authentication Set Up

Automated Signature

How to Register a Guest on BBB - Guest Wi-Fi

Dot Matrix printing - How to and Troubleshooting

How to Log a Support Ticket in Odoo

How to Log a New Feature request Ticket in Odoo

Sales Force

Promotion

Demotion

Pay-In Sheets

Create and print pay-in sheets pack

Register pay-in sheets

Capturing pay-in sheets

Register pay-in sheets distributor summaries

Capturing Pay-In Sheets Distributor Summaries

Create a Cosultant

Activating inactive sales force member

VoIP

Blacklisting

Suspend

Moving Consultants

Sales Force Member Information Edits

PaySpace

Contact Centre

MVNO

How to purchse data, voice, SMS and check the balance on BBB Connect HelpDoc

How to port/transfer your current SIM card number to BBB Connect SIM card

How to Recharge BBB Connect SIM card

TaskFlow

How to set up sales force meetings campaign

Making Inbound and Outbound calls for contacts 'Potential Leads'

How to create a user

How to make a sales force meeting call

How to set up extensions

How to configure sales force meetings

How to set up dispositions

How to set up a recruiting campaign

How to set up call teams

How to call the Leads and Recruits

Campaign Planner

Table of Contents

- All Applications

- Purchase

- Orders

- Foreign Purchase Order

- Capture a Vendor Bill - Foreign

Capture a Vendor Bill - Foreign

Introduction

Once the GRV Receipt is completed, the Inventory Clerks will need to capture the Vendor Invoice. This step occurs after the Procurement manager has confirmed that the payment dates, delivery dates and costs on the Purchase Order correlate with the Vendor's Invoice.

Responsible Team

- Procurement & Stock Management Clerk

- Procurement Manager

- Warehouse Manager

Navigation

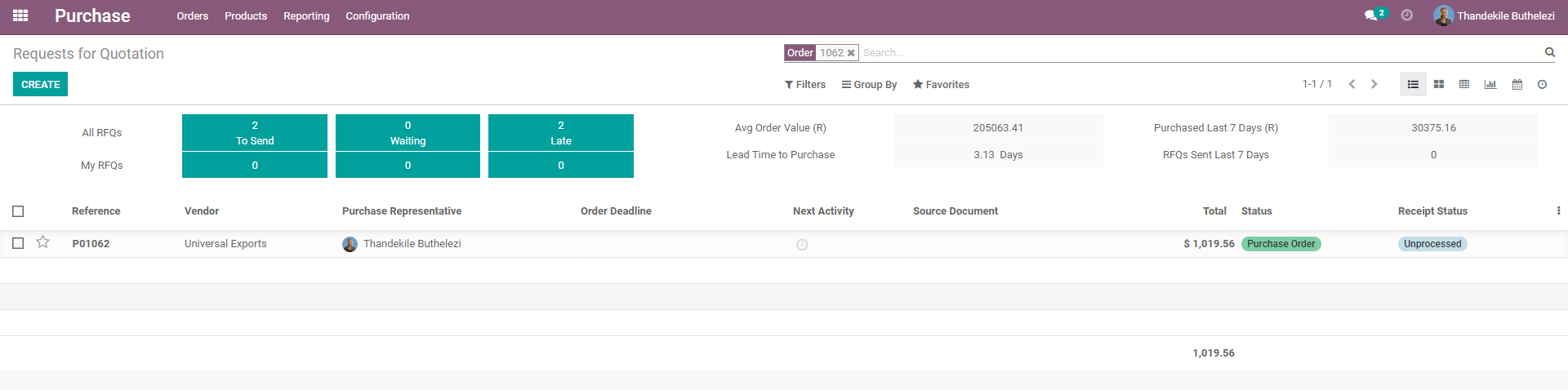

Navigate to your Odoo dashboard and click on this application: Purchase

Navigate as follows to get to the correct screen:

Orders/Purchase Orders

On the search bar at the top, type in the PO code, you should now land on a screen that looks like this:

Process

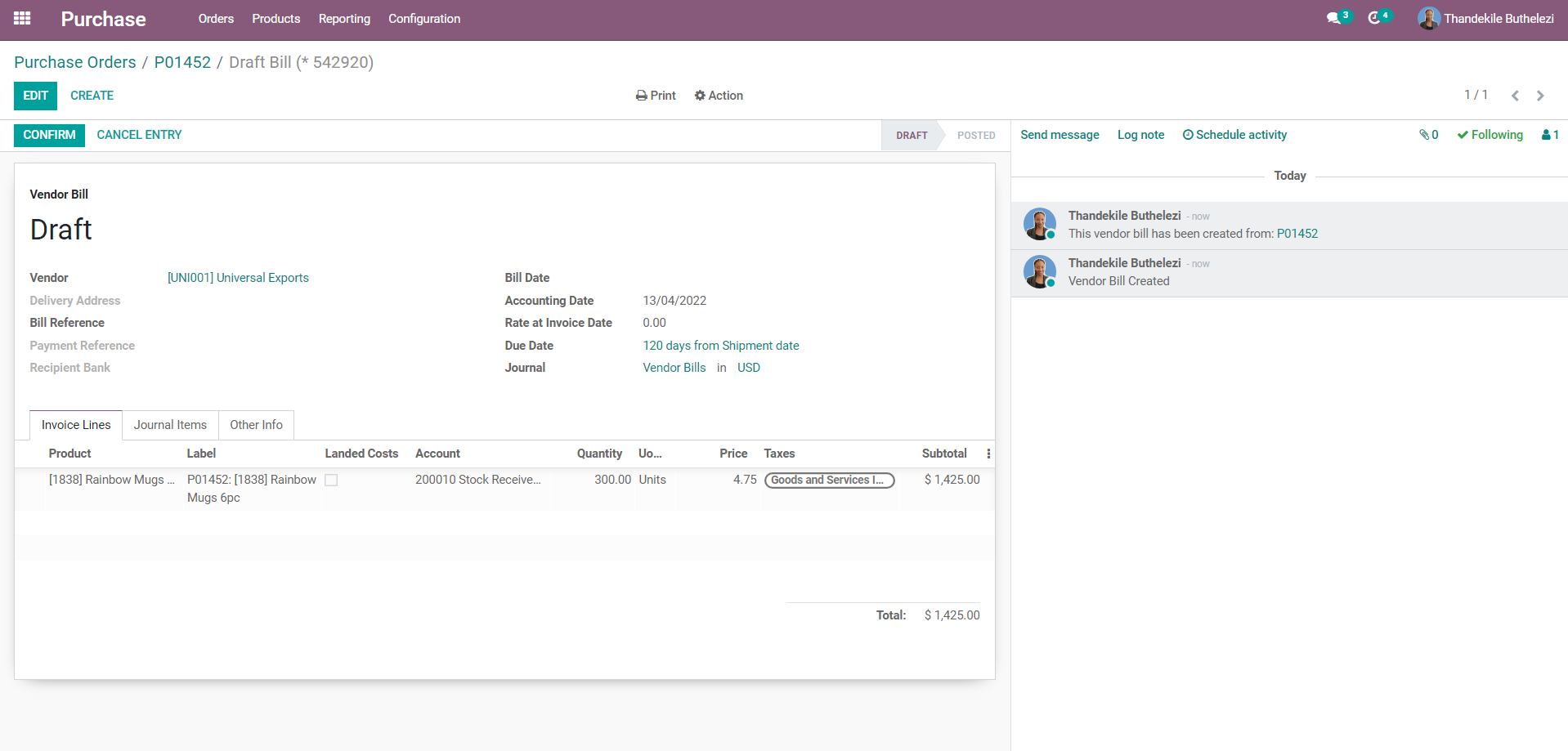

- Select the correct Purchase Order, click [CREATE BILL], your screen should look like this:

- Click [EDIT].

- Update the data under the following headings, as per the invoice:

- Enter the invoice date under the field labelled Bill Date.

- Enter the quantity per item, as per the received Invoice.

- If the unit quantity captured on the vendor bill is more than the unit quantity captured on the receipt, a draft Vendor credit note will be automatically generated.

- If the unit quantity captured on the vendor bill is less than the unit quantity captured on the receipt, an additional draft Vendor Bill will be automatically generated.

- Once you've entered the correct quantities, and dates as required, click [CONFIRM].

- After confirming, the next step is to create the Landed Cost Bill for the Supplier (Commission) , Trade Finance and Freight Forwarding company